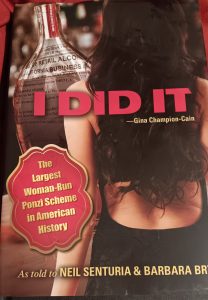

She did it! New book tells the story of Gina Champion-Cain’s Ponzi scheme

Entrepreneurs and writers Neil Senturia and Barbara Bry recently clued La Jollans in on the Gina Champion-Cain liquor license scandal revealed in a book they co-wrote titled “I Did It.”

The couple’s presentation on the largest woman-run Ponzi scheme in American history was given at the Rotary Club of La Jolla, which meets Tuesdays at noon at La Valencia Hotel.

Champion-Cain, a long-time San Diego business leader, restaurateur, and real estate magnate was sentenced in federal court to 15 years in prison for masterminding a massive, years-long Ponzi scheme and obstructing justice by hiding and destroying evidence from federal investigators.

When she pleaded guilty on July 22, 2020, Champion-Cain admitted to raising more than $350 million from investors by promising to use their money to make loans to business owners who were attempting to acquire California liquor licenses. She and her co-conspirators instead used funds from new investors to pay back others whose investments would soon be redeemed and embezzled funds to support her other businesses and her lifestyle.

Champion-Cain and her co-conspirators kept the scheme going by, among other things, fabricating documents, forging signatures, and telling investors lies through fake email accounts.

Senturia told Rotarians he and Bry knew Champion-Cain socially and through her real estate business. He said she emailed him one day in early 2020 complimenting him on one of the business columns he writes for the San Diego Union-Tribune. He added that Champion-Cain later expressed her willingness to “tell her story” about the Ponzi scheme scandal.

“I did most of the interviews. Barbara read all of the transcripts and the many lawsuits, and then we wrote the book together,” Senturia told Rotarians during an interactive Q&A.

Senturia laid out Champion-Cain’s game plan for creating a Ponzi scheme designed to raise money initially to remodel the Patio On Lamont restaurant in PB, which she’d purchased. “She solicited investors promising them 10% to 12% (return), in a world which is 3 or 4%,” noted Senturia adding, “And she says, ‘We’re going to invest in liquor licenses.’ Normally what happens is liquor licenses are financed. An investor, or owner, puts in $50,000 or $100,000, and you go through the (application) process and you get a license and you pre-pay it. And the money for liquor licenses is held in escrow. And the primary escrow holder, in this case, and many cases, was Chicago Title.”

Concluded Senturia: “Her scam was great. At the end of the day, what she figured was this: If you take money to buy liquor licenses, but you never buy the licenses – that’s a really good business. She had 290 investors solicited by her and others.”

“These liquor licenses you were supposedly investing in weren’t real, she just created the numbers,” explained Bry. “She would have to give a name of a real restaurant or bar, and she never picked one in Southern California, only ones from out of town. She had a whole spreadsheet system with the name of the license, the fake number that she created, how much money she’d taken from the investor, and the interest rate that was promised. And she sent forms to everybody every year on how much interest they had theoretically earned.”

In excerpts from “I Did It,” Champion-Cain said, of the financial scandal and her intentions: “I truly believed, given enough time, that I could and would make it right and make everyone whole. I didn’t even know the names of most of the investors – people I’d never heard of or met simply wired money. … The reason no one ever complained was because everyone got paid like clockwork. I used the liquor license program money to fund the business empire that I’d always wanted. I knew that I was giving away money that wasn’t mine.”

At the end of “I Did It,” Champion-Cain noted: “My story is still being written, and I think the next chapters of my life will be called redemption and atonement. I truly understand how tenuous one’s grasp of reality can be. I needed to believe that I could outrun the inevitable. There were countless times when I wanted this program to stop.”

Concluded Champion-Cain: “On the way down, it was a hell of an intoxicating ride. People were happy, they were all making lots of money. I was employing people, serving on civic boards, and making charitable contributions. I was famous. Until I was infamous.”

PONZI

A Ponzi scheme is a form of fraud that lures investors, paying profits to earlier investors with funds from more recent investors. Named after Italian businessman Charles Ponzi, this type of scheme misleads investors by either falsely suggesting that profits are derived from legitimate business activities (whereas the business activities are non-existent), or by exaggerating the extent and profitability of the legitimate business activities, leveraging new investments to fabricate or supplement these profits. A Ponzi scheme can maintain the illusion of a sustainable business as long as investors continue to contribute new funds, and as long as most of the investors do not demand full repayment or lose faith in the non-existent assets they are purported to own.

The authors – Both entrepreneurs and a married couple, Neil Senturia has written sitcoms in Hollywood, developed real estate, and writes a weekly business column for the San Diego Union-Tribune. Barbara Bry was a business writer for the Sacramento Bee and Los Angeles Times, as well as a former San Diego City Council member representing District 1. She served on the initial management team of the e-commerce company ProFlowers.

Categories

Recent Posts

![San Diego Whale Watching – Best Tours, Season & Tips [2025]](https://img.chime.me/image/fs/chimeblog/20250211/16/w600_original_a3dc20a3-a13b-4120-85c7-11e29d5d609f-jpg.webp)